There have been a lot of recent press comment on US firms buying up UK tech businesses, and this has certainly been the case. This has also been helped by the exchange rate making UK businesses more affordable to overseas buyers.

However, putting technology as a sector to one side, I recently attended a very interesting webinar from MarktoMarket and a detailed assessment on the overseas buyers of UK companies and where they are coming from and what sectors they are buying into.

The data and screenshots all come from MarktoMarket, and the data comes from the last four-year period.

Domestic v Overseas Buyers

- Firstly, the data shows that of all the UK businesses acquired, in 2023, 78% of the businesses were acquired by other UK businesses and 22% were acquired by overseas buyers.

- Surprisingly, this data has actually been very consistent over the past 4 years with virtually no change year on year to these percentages

- Of the 22% overseas buyers, it is mainly the US. Nearly 40% of them are US buyers and the next largest after the US is the combined Nordic Region but at just under 10%

- After that is France, Republic of Ireland and Germany

- The key change over the 4-year period has been the decline of buyers from Canada which has declined by 50%

The Most Active Buyers

- From the data and with no size filter, the top five active buyers are Arthur J Gallagher (Insurance), Carlyle and MacQuarie (Financial Buyers), Private Equity and Trade Buyers.

- The bulk of these are US firms. Arthur J Gallagher stands out at the top having completed 70 deals in 2023.

Smaller End of the Market

When you look at the smaller end of the market and the sub £20m deals, the composition of businesses and their location changes considerably. The top ten types and locations are:

| Type of Business | Location |

| Insurance | US |

| Engineering | Sweden |

| Media | Germany |

| Private Equity | Germany |

| Renewable Energy | Germany |

| Engineering | Sweden |

| Waste | France |

| Testing | France |

| Infrastructure |

Australia |

| Electronics | Sweden |

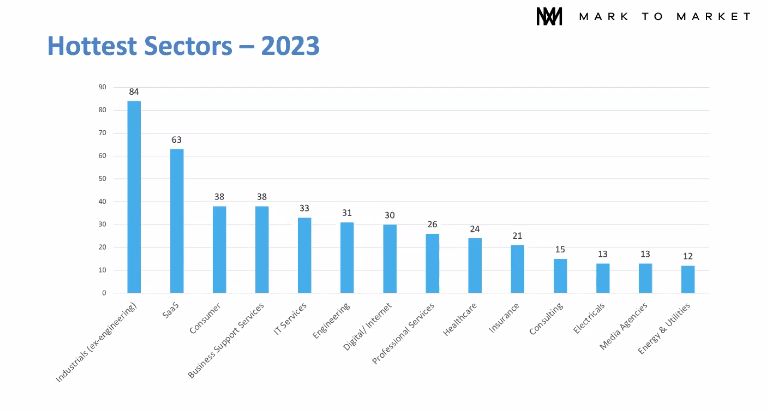

Hottest Sectors

A closer look at the hottest sectors that overseas buyers have been deal making in shows the following, with the top 5 sectors being industrials (excluding engineering), SaaS, Consumer, Business Support Services and IT Services.

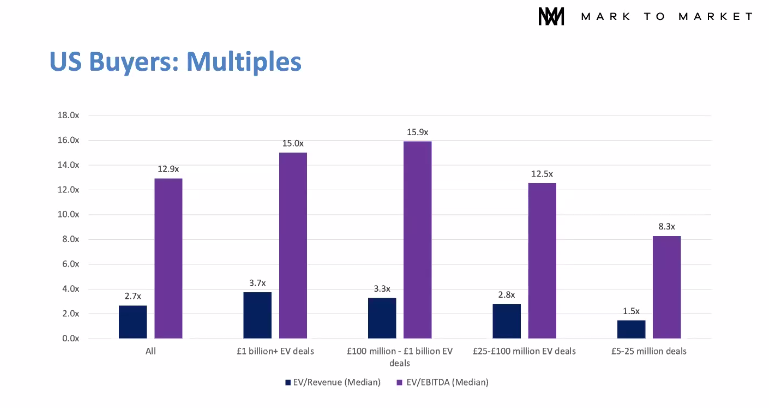

US Multiples Paid

Looking at the largest overseas buyer, the US, the following table shows the average EV/Revenue and EV/EBITDA Multiples being paid for the companies they are buying. As can be seen the largest multiples are seen at the highest end of the deal spectrum from £100m to £1bn and beyond.